New year, new money goals. Learn why financial resolutions fail and how to make them stick with specific goals, smart planning, and accountability.

Browsing: Family Finances

Now’s the time to reevaluate your insurance policies to start the year off right.

AI is reshaping money management with smart budgeting tools and robo-advisors, but it can’t replace human insight. A hybrid approach offers guidance grounded in both data and values.

Local financial advisor Jeremy Blubaugh walks through financial risk at different stages of life.

Alex Hutton, chief information

security officer at Atlantic Union Bank, shares tips on how to prevent AI fraud this holiday season.

Successful investing isn’t about quick wins or trendy tips—it’s about patience, quality investments, and a durable long-term strategy that weathers market ups and downs.

Paula Buckley with GRASP shares tips for finding financial aid for college.

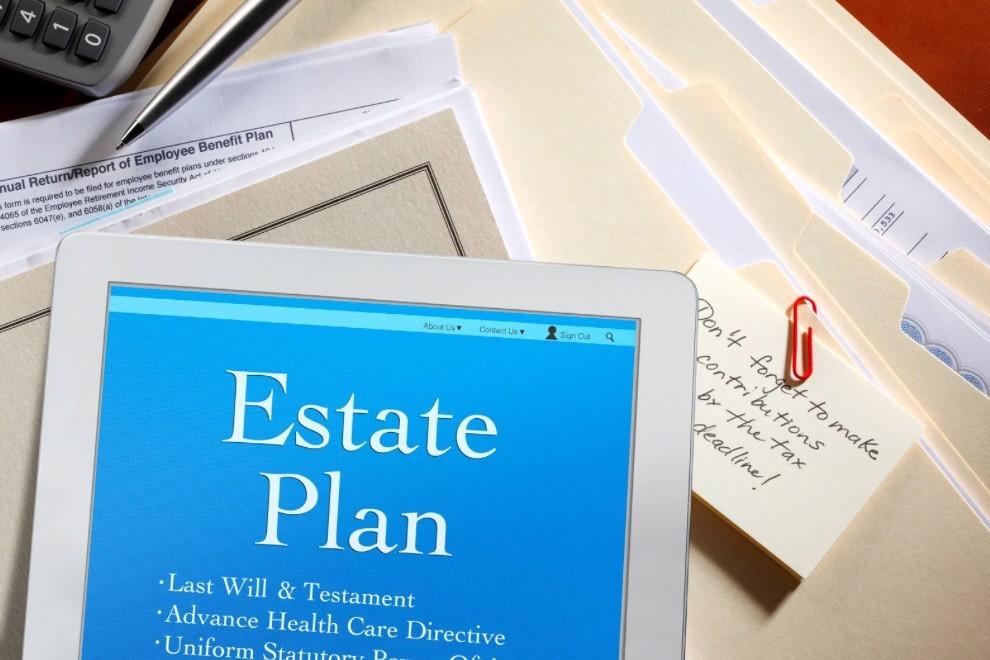

Tips to plan your financial future holistically, considering family, beliefs, health, retirement purpose, and legacy.

Think estate planning is only for the wealthy or elderly? Think again. If you own anything — a home, a car, a savings account, even a pet — you already…

Here are a few steps to take to test your retirement income.

Understand the benefits of opening a 529 account, presented by a financial expert.

Discover steps to take shortly after job loss to help put you in the best financial position.